Claim Process Guide

Navigate the complex world of insurance claims with our step-by-step guide to streamline your claim process.

Step 1: Notify Your Insurer

As soon as an incident occurs, contact your insurance company. Quick notification is crucial for a smooth claim process. Many insurers offer 24/7 claim reporting services.

Step 2: Document Everything

Gather all relevant information about the incident. This may include photos, police reports, medical records, and witness statements. The more documentation you have, the stronger your claim will be.

Step 3: Claim Assessment

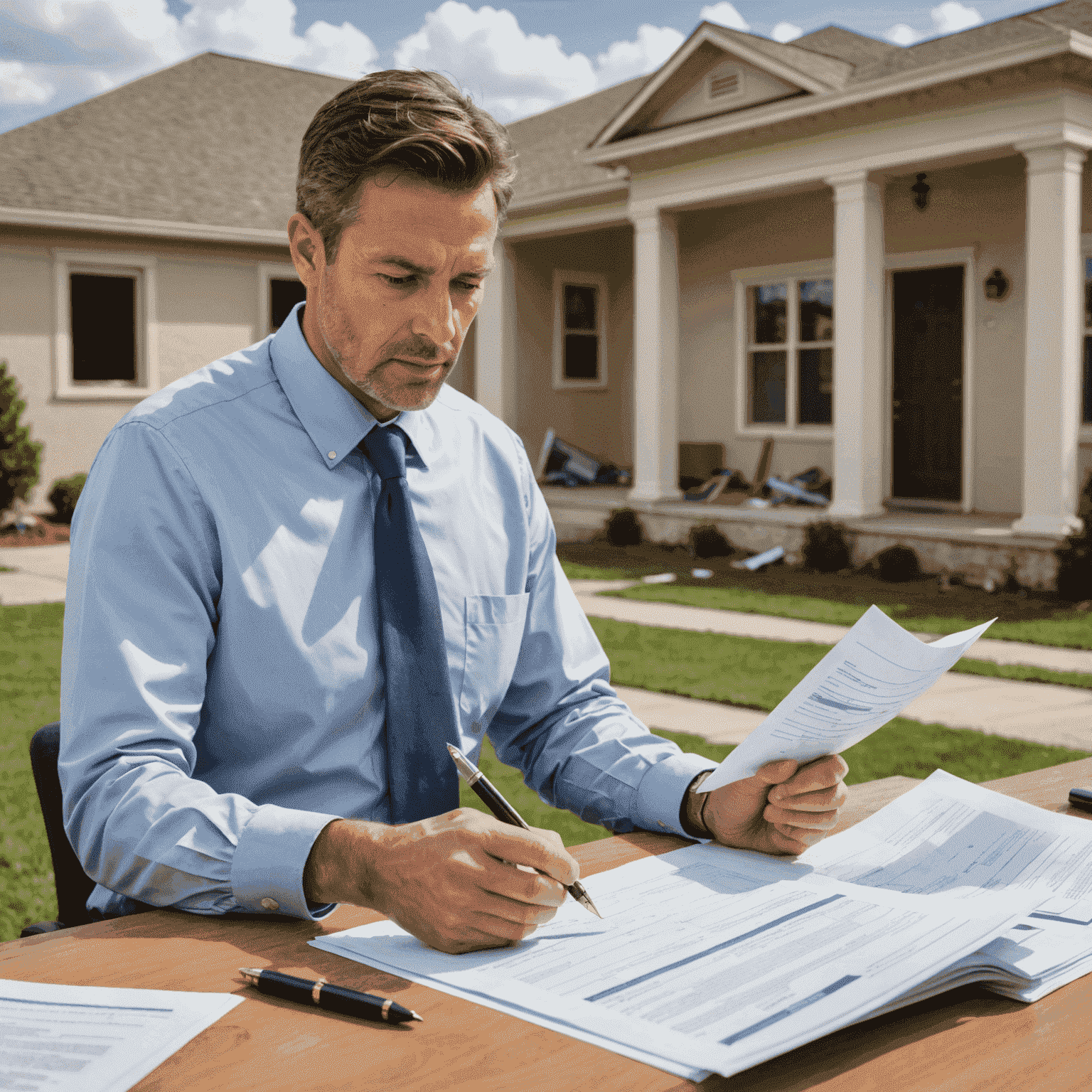

An insurance adjuster will be assigned to your case. They will review your claim, assess the damages, and determine the coverage based on your policy. Be prepared to provide additional information if requested.

Step 4: Negotiation and Settlement

Once the assessment is complete, your insurer will offer a settlement. Review this carefully and don't hesitate to ask questions or negotiate if you feel the offer is inadequate. Remember, you have the right to dispute the settlement if necessary.

Step 5: Claim Resolution

After agreeing on the settlement, your claim will be resolved. This may involve receiving a payout, having repairs authorized, or other actions depending on your specific situation and policy.

Tips for a Smooth Claim Process

- Keep detailed records of all communications with your insurer

- Understand your policy coverage before filing a claim

- Be honest and accurate in all your statements

- Don't rush to accept the first settlement offer if it seems low

- Consider seeking professional help for complex claims

Remember:

Every insurance claim is unique, and the process may vary depending on the type of claim and your specific policy. Always refer to your policy documents and consult with your insurance provider for the most accurate information regarding your claim process.